Welcome - Earley NAG Community Forum

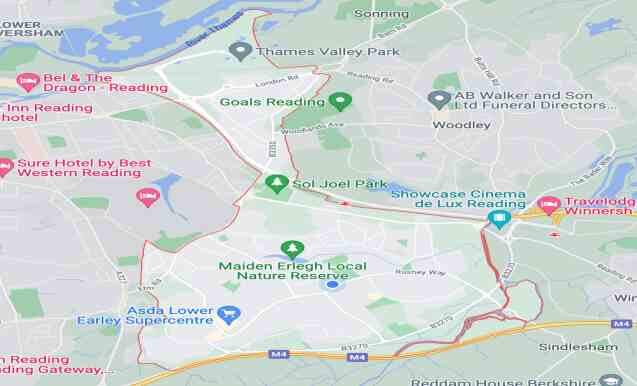

Map of NAG focus area

The Earley Neighbourhood Action Group (NAG) is an open public organisation set-up in partnership with Thames Valley Police and Earley Town Council in order to help understand, prioritise and resolve local neighbourhood concerns. Liaising with those accountable for delivering local services

Members

The action group is made up of local residents, councillors, businesses and institutions who have an interest in the well being of the community. All residents are encouraged to come along and participate.

Meetings

The group meets bi-monthly every 8 weeks from 7:30pm onwards in the main meeting room at Earley Town Council or by Zoom where it discusses local issues such as crime, litter, road safety, and anti-social behaviour

MAKE A DIFFERENCE

The purpose of our work at the NAG can be broken into these key initiatives:

Reporting crime & suggesting how our community can be better served

Recommending policies to protect vulnerable people

Improving community awareness of modern crimes such as cybercrime and fraud

Identifying fly tipping and illegal encampments (reducing the impact of such encampments)

Monitoring and suggesting improvements to local Council Services such as but not limited to Traffic, Lighting and potential impact on community safety regarding proposed developments

Community Speedwatch UK

Building a Community with Neighbourhood Watch

NEW TEAM TO LEAD COUNCIL’S CRACKDOWN ON ANTI-SOCIAL BEHAVIOUR

Consumer's Associaion Free Scam Alert Sevice

Contact Us

Feel free to contact us any time. We will get back to you as soon as we can.

Address

Earley NAG Community Forum C/o

Earley Town Council

Council Offices, Radstock House, Radstock Lane, Earley, Berkshire RG6 5UL